Allcargo Logistics is one of the top logistics companies in India and one-stop supply chain management solution that provides logistics solutions across 160+ countries. It is known to offer multi-modal integrated logistics and transportation services worldwide.

Allcargo’s worldwide supply chain business (MTO division) is managed by ECU Worldwide. Its multi-modal transport business includes consolidation of less-than-container load (LCL), full container load (FCL), imports and exports forwarding, air freight, movement of over-dimensional and project cargo, and multi-city consolidation-exports and imports.

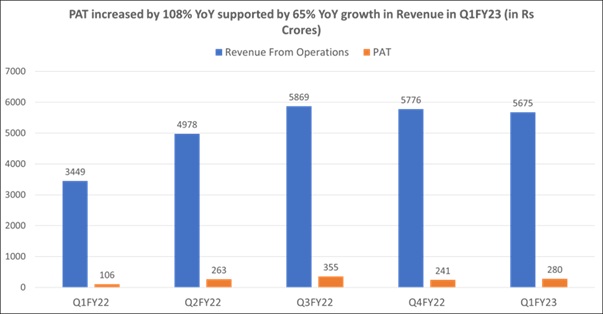

Allcargo Logistics announced their Q1FY23 results on 10th August 2022. They saw almost 100% growth in margins YoY, which was supported by 65% YoY growth in revenue. Their strong growth momentum was driven by robust transformations, strategic buyouts, and healthy growth prospects in user industries. They also have demerger process going on, which is on track with their strategic goals. The stock has delivered a return of almost 58.6% in last 1 year and 212% in last 2 years. Allcargo shares appear to be still bullish, with prospects of delivering more than 50% return in medium to long term. Let’s now understand the reason for the same by analysing their fundamentals and reasons for prospective buy.

Key highlights of Allcargo Logistics results Q1FY23:

For Q1FY23, Allcargo Logistics recorded a consolidated PAT increase of more than two times, to Rs 280 crore

It also saw a revenue growth of 65% YoY to Rs 5,675 crores in Q1FY23, while on a sequential basis revenue declined 1.7%, while PAT increased 16% QoQ

During Q1FY23, the LCL volume growth spiked 70% YoY while the FCL (full container load) volume grew 10% YoY

Allcargo’s EBITDA doubled to Rs 434 crore in Q1FY23, while their margins came in as 8% in Q1FY23, up by almost 2% from 6% in Q1FY23.

Allcargo Logistics completed its second significant international acquisition last year when it bought a 65% stake in Nordic, a Swedish logistics company

Allcargo results Q1FY23: Revenue grew 65% YoY along with robust growth in Key business segments

Allcargo Logistics recorded a consolidated PAT increase of more than two times, to Rs 280 crore, from a PAT of Rs 106 crore in Q1FY23. This has been supported by a revenue growth of 65% YoY to Rs 5,675 crores in Q1FY23, from Rs 3,449 crores in Q1FY22. While on a sequential basis revenue declined 1.7%, while PAT increased 16%.

Further, the LCL accounts for two-thirds to three-fourths of the business while the FCL (full container load) services the remaining one-fourth to one-third. So, during the Q1FY23, the LCL volume growth spiked 70% YoY while the FCL (full container load) volume grew 10% YoY.

While the growth in the key business segment on a yearly basis also saw an upsurge. The international supply chain business (MTO segment) operating under ECU Worldwide saw robust growth. The ocean freight rates have seen a declining trend over the last 3-4 months, Allcargo said. Further, there has been a sustained increase in revenues coming through the digital platform ECU360, which now accounts for over 60% of export bookings across all key markets, it added.

Allcargo results Q1FY23: EBITDA almost doubled backed by significant growth in CFS-ICD business

The Allcargo’s EBITDA (Earnings before interest, taxes, depreciation, and amortisation) doubled to Rs 434 crore in Q1FY23 from Rs 217 crore in Q1FY22. While on a sequential basis it increased slightly by 60 Bps. Their margins came in as 8% in Q1FY23, up by almost 2% from 6% in Q1FY23.

CFS-ICD business has demonstrated significant growth in volumes over last year. With sharper focus on customer analytics, the business has improved the EBITDA margins over previous quarter with strong RoCE of over 31%. Volumes handled for the quarter stood at 138,300 TEUs as against 82,500 TEUs handled in Q1FY22.

Other Key business updates and Future plans: Including Demerger and strategic acquisitions

The company has recently announced its intent to restructure express and contract logistics businesses and engaged in discussions with its JV partner in express business to buy out their shareholding. Restructuring would be planned on the principles of simplicity in structure and effectiveness in management.

The company continues to focus on asset light businesses and evaluate strategic acquisitions across the world to further strengthen its competitive positioning. Even their demerger process continues to remain on track with each demerged business to be listed separately with mirror shareholding. With demerger they plan to strengthen their core with each separated unit focusing on their independent growth strategies.

Further, Allcargo Logistics completed its second significant international acquisition last year when it bought a 65% stake in Nordic, a Swedish logistics company that dominates the LCL and rail freight consolidation markets in the Nordic countries. While they are still looking for more takeover prospects in particular regions.

“When we look for acquisitions, we are looking for a very strategic acquisition to specific geographies,” said Ravi Jakhar, Chief Strategy Officer at Allcargo Logistics. He said the acquisition of Nordic last year, which is a strategic acquisition, has been very successful for the company.

Our View and Technical Analysis Allcargo logistics share:

Allcargo Logistics share have seen an up-move post making a low of 249 in June 2022. This was after the completion of Q1FY23. Technically, the stock is bullish, along with a recent bullish EMA crossover, that can also be seen on the charts. On the long term charts, the chart has broken out of its resistance of 400 and is likely to continue its upward movement over the next few months.

The company has delivered good Q1FY23 results and is expected to perform well in upcoming quarters as well, as supported by management’s strategic viewpoint as well.

“In the coming quarters also, we will continue to evaluate opportunities, strategic acquisitions, which can help us further consolidate our market leadership,” said Ravi Jakhar, Chief Strategy Officer at Allcargo Logistics. Therefore, Allcargo stock offers a robust opportunity for long term investors.

About the Author

Ketan Sonalkar (SEBI Rgn No INA000011255)

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.