In the intricate world of personal finance, the allure of compound interest stands as one of the most powerful allies for wealth accumulation over time. Whether you’re an aspiring investor or simply someone keen on maximizing your savings potential, understanding the compound interest formula can fundamentally transform your financial trajectory. This article delves into the principles of compound interest and how leveraging this powerful tool can propel your long-term financial growth.

Understanding Compound Interest

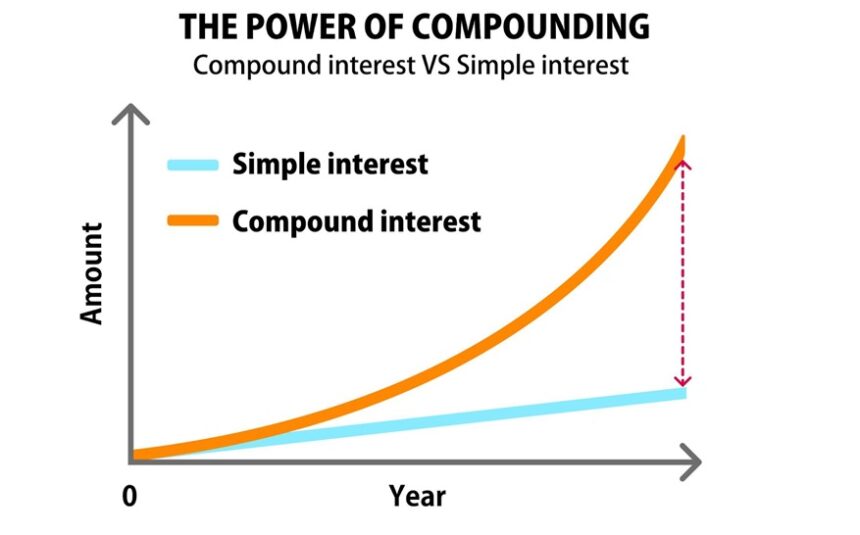

To embark on the journey of understanding compound interest, one must first grasp what it is. Unlike simple interest, which is calculated only on the principal amount, compound interest is calculated on the initial principal and also on the accumulated interest from previous periods. This accelerates the growth of your investments, as the interest generated itself earns additional interest over time.

The Compound Interest Formula

The compound interest formula is a mathematical expression that allows individuals to calculate the future value of an investment. The formula is:

A=P(1+r/n)ntA = P (1 + r/n)^{nt}A=P(1+r/n)nt

Where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial sum of money).

- r is the annual interest rate (decimal).

- n is the number of times interest is compounded per year.

- t is the number of years the money is invested or borrowed.

Understanding this formula is crucial for anyone looking to make informed decisions about their finances, as it provides insight into how different factors such as interest rates and compounding frequencies can impact the growth of your investments.

The Impact of Frequency in Compounding

Compounding can occur at various frequencies—annually, semi-annually, quarterly, monthly, or even daily. The higher the frequency, the more interest is earned on previous interest, accelerating the growth of the investment. For instance, if two accounts have the same annual interest rate, the one with monthly compounding will grow larger over time than the one with annual compounding.

Utilizing a Personal Loan Interest Rate Calculator

While compound interest is a boon for investments, it can have different implications when dealing with loans. Taking out a loan involves paying interest, which can also be compounded based on the lending terms. This is where a personal loan interest rate calculator becomes invaluable.

With a personal loan interest rate calculator, individuals can input various parameters such as the loan amount, interest rate, and loan term to estimate the total cost of the loan and repayment amounts. This tool is crucial for borrowers to assess different lending options and choose the most cost-effective ones, helping to minimize the compound interest impact on loans.

The Benefits of Long-Term Investment

One of the compelling aspects of compound interest is its ability to grow an investment exponentially over the long term. For individuals aiming for long-term financial goals, such as retirement savings or children’s education funds, investing with compound interest in mind can yield significant benefits.

Time and Patience: Keys to Maximizing Compound Interest

The most crucial factor in maximizing compound interest benefits is time. The longer the investment horizon, the greater the impact of compounding. Even small contributions can grow substantially if invested early and consistently. Patience is essential—financial growth through compounding doesn’t happen overnight but rather through consistent effort and wise investment choices.

Strategies to Enhance Growth with Compound Interest

To fully leverage the power of compound interest, it’s important to employ effective strategies that enhance growth. Here are some key strategies:

1. Start Early

The earlier you start investing or saving, the more time your money has to grow. Even modest contributions made regularly over a long period can result in considerable financial growth due to compounding.

2. Contribute Regularly

Consistent contributions to investment accounts can substantially increase final savings. By making regular deposits, you continually add to the principal amount, which compounds over time.

3. Diversify Investments

Diversifying your portfolio helps manage risk and can potentially improve returns. Consider varying investment vehicles like stocks, bonds, and mutual funds to capitalize on different growth opportunities.

4. Reinvest Dividends

If your investments pay dividends, reinvesting them can increase the principal amount, further augmenting the effects of compound interest.

The Caveat: Understanding Risk

While compound interest offers immense potential for growth, it’s vital to understand associated risks. Investments can fluctuate and markets may sometimes be volatile, affecting the returns. Therefore, with higher interest rates often comes higher risk. Balancing risk with return is key to a healthy growth strategy.

Conclusion

Compound interest is not just a financial concept; it is a powerful force that can significantly impact long-term financial growth when harnessed effectively. Utilizing the compound interest formula allows individuals to project the potential growth of their investments, while tools like the personal loan interest rate calculator aid in making informed borrowing decisions.

Remember, the key to leveraging compound interest lies in starting early, contributing regularly, and staying patient. Coupled with a sound strategy and understanding of risks, compound interest can be a great ally in achieving financial goals and securing a prosperous future. As you embark on your financial journey, let the power of compound interest be your guide towards long-term growth and stability.